Last updated on 2019-09-13

What do you plan on doing when you retire? Do you imagine Florida or a hut somewhere in the mountains? Or maybe you don’t plan on changing your life at all? Whatever you think you’re going to end up doing, you’re going to need a budget for it.

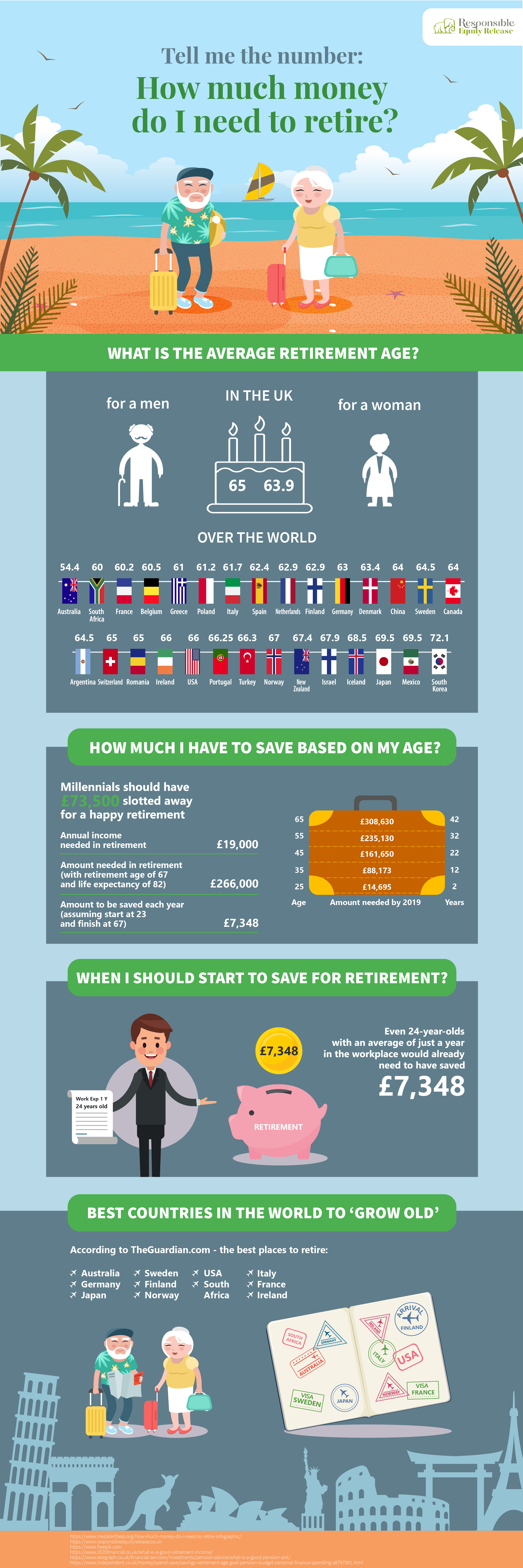

In most cases, sadly, your budget is going to decide what you end up doing, and if you end up working past your retirement age in order to sustain your lifestyle. If you’re past 30, statistics are already against you. (Sorry, Millenials!)

If you’re past 40 and don’t own an asset like land or a house, maybe it’s time to start thinking about it. Not ready to settle? Think of it as a long term investment, not an anchor that ties you down.

Because just putting money away and keeping it in a retirement account can be very daunting, you can consider investing in something you can enjoy before retirement.

A shortlist of investments like this can include:

- A house, so you can enjoy responsible equity release when you are ready.

- Land – this is a very safe bet because (unless a sinkhole opens up) there is no maintenance involved, and investment opportunity are endless.

- Become a small business investor – if you like a challenge and paying it forward, invest in a friend’s company. If you don’t have a business-minded friend, you can find a place where you can invest in start-ups that you believe in at places like wefunder.com.

There are many options in addition to your regular retirement funds and savings. If you’d like to see how much you really need according to statistics, take a look at this infographic and try not to panic!

Be First to Comment